Condo Insurance in and around Eureka

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

- California

- Oregon

- Arizona

Welcome Home, Condo Owners

Because your home is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to theft or lightning. That's why State Farm offers coverage options that may be able to help protect your condo and its contents.

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

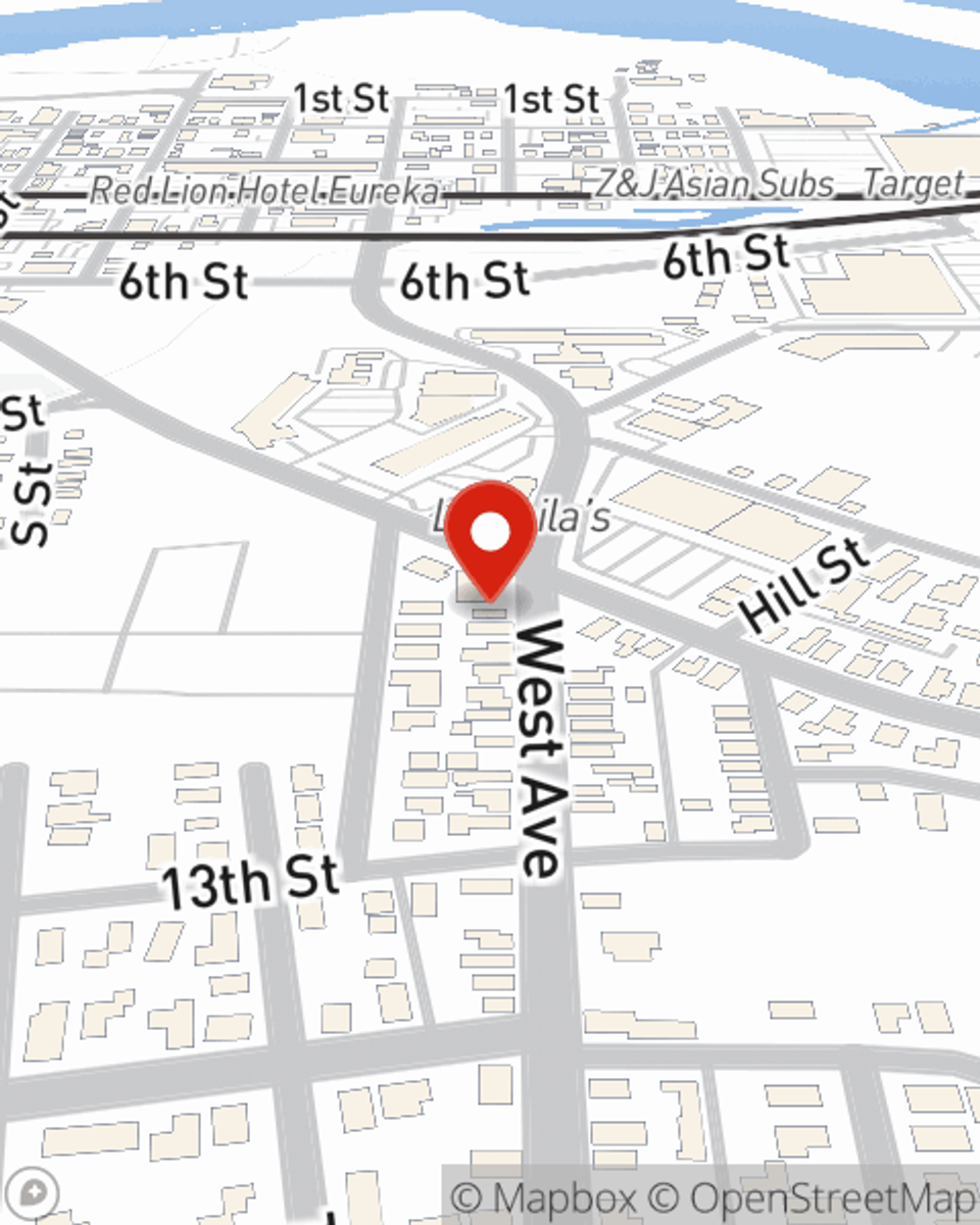

Agent Lisa Fryrear, At Your Service

You can rest assured with State Farm's Condo Unitowners Insurance knowing you are prepared for the unpredictable with wonderful coverage that's right for you. State Farm agent Lisa Fryrear can help you understand all the options, from possible discounts, bundling to replacement costs.

As one of the top providers of condo unitowners insurance, State Farm has you covered. Call or email agent Lisa Fryrear today for help getting started.

Have More Questions About Condo Unitowners Insurance?

Call Lisa at (707) 268-0911 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Lisa Fryrear

State Farm® Insurance AgentSimple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.